There are many tales of regular people doing amazing things on Facebook. A man called Chad started a nonprofit The Giving Trees which provided more than 2,300 families through Facebook. A woman called Tammy is serving sweets on a truck purchased from a Facebook user after her trolley tour business was shut down. There is also a story about a woman called Tania, whose niche dollhouse business blew up through Facebook Marketplace. At this point, Facebook is everywhere, and its impact on the world is undeniable.

How did the Facebook company start? As a college experiment that changed the Internet for good.

Facemash and TheFacebook

In 2003, Mark Zuckerberg launched a website called Facemash. The idea was to allow Harvard students to rate each other based on photos, which picked up very quickly. The website had over 22,000 views within hours and was shut down within days because the photos were posted without permission.

A year later, Zuckerberg launched another website called TheFacebook with Eduardo Saverin. They were joined by Dustin Moskovitz (programmer), Andrew McCollum (graphic artist), and Chris Hughes (management). Together, they expanded the website to all Ivy League and Boston-area schools.

Initial funding in Facebook

Venture capitalists Peter Thiel and Reid Hoffman were the first angel investors. Accel Partners joined the Series A investment round in 2005, and at that point, the Facebook company value was close to $100,000. Series B was led by Greylock Partners and Meritech Capital. But everything changed when Microsoft came in Series C, during which the company was valued at around $15 billion.

Facebook reported positive cash flow for the first time in 2009, and the switch to serious profitability happened in 2012 – up 65% to $1 billion.

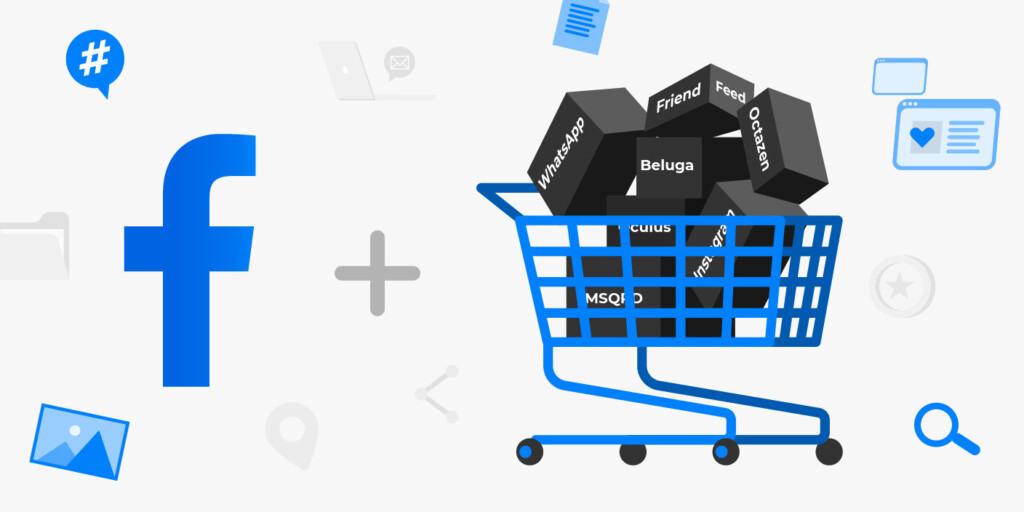

Evolving through acquisitions

Zuckerberg once said, “We have not once bought a company for the company. We buy companies to get excellent people”. Although, he’s made a few exceptions since then.

Here is a list of primarily talent-focused acquisitions over the years (notable ones):

- August 2009: FriendFeed (social media news aggregator)

- February 2010: Octazen Solutions (contact-importing software)

- March 2011: Beluga (group messaging service)

- April 2012: Instagram (photo-sharing service)

- February 2014: WhatsApp (instant messaging app)

- March 2014: Oculus (VR)

- March 2016: MSQRD (AR)

- September 2019: CTRL-labs (brain-machine interface)

- November 2020: Kustomer (customer experience, service, and support)

Surviving controversies

Facebook is no stranger to controversies. One of the most publicized ones, a data breach linked to political consultancy Cambridge Analytica. As a result, the FTC ordered the company to pay a record-breaking penalty and to restructure its approach to privacy. The Facebook company culture was described as “cult-like” and made responsible for the workers’ lack of work-life balance.

Criticism and legal action may hurt Facebook, but it’s already too strong to fail.

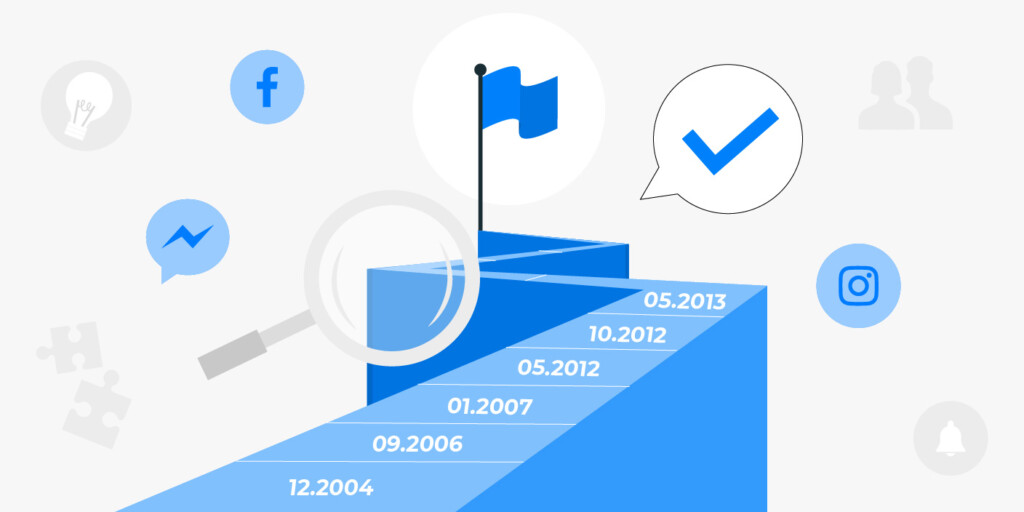

Major milestones in Facebook’s growth

There is no way to make an exhaustive list of Facebook milestones, but last to hit the major events:

- December 2004: The first million platform users

- September 2006: Launch of News Feed

- January 2007: Facebook goes mobile

- May 2012: Facebook launches an IPO at $38/share

- October 2012: Membership surpasses 1 billion users

- May 2013: Facebook joins the Fortune 500

- April 2015: 40 million active small business pages

- January 2016: Launch of Facebook Live

- June 2021: Peak market value of $1 trillion

- October 2021: Facebook rebrands as Meta

- June 2022: Expansion of Horizon Home (multi-player virtual platform)for Quest 2 users

As of 2023, Facebook is worth $320 billion, once again confirming its status as the biggest and most successful social media platform.

Important acquisitions of Facebook

Facebook has made several strategic acquisitions over the years that have helped the company expand its reach and improve its offerings.

Instagram was acquired by Facebook in 2012 for $1 billion. At the time, Instagram was a relatively new photo-sharing app that was rapidly gaining popularity. The acquisition allowed Facebook to tap into the growing mobile photo-sharing market and integrate the platform into its offerings. Today, Instagram is one of the largest social media platforms in the world, with over 1.386 billion active users.

Masquerade was acquired by Facebook in 2016. The company was known for its popular face-tracking technology, which allowed users to add fun filters and effects to their photos and videos. This acquisition was a clear play by Facebook to compete with Snapchat, which was growing rapidly at the time and had popularized the concept of using filters and lenses in photos and videos.

WhatsApp Messenger, which Facebook acquired for $19 billion back in February 2015, has been their biggest acquisition. Other noteworthy purchases include Oculus VR ($2 billion, acquired in March 2014).

One of Facebook’s less expensive acquisitions was the domain name fb.com, which it acquired for $8.5 million in November 2010, as well as the hosting and sharing service Drop.io, which it acquired for $10 million in October 2010.

Facebook’s integration of popular formats

As social media has evolved, Facebook has sought to stay ahead of the curve by integrating popular features from other platforms. One notable example is the introduction of Stories, a feature that allows users to share photos and videos that disappear after 24 hours. This format was originally popularized by Snapchat and later adopted by Instagram. In response, Facebook integrated Stories into its main platform, as well as Instagram and WhatsApp.

Another example is the integration of vertical video into Facebook’s offerings. This format, which is taller and narrower than traditional video, was popularized by platforms like TikTok and Instagram. In response, Facebook has added support for vertical video in both its main platform and Instagram.

These strategic integrations have allowed Facebook to remain competitive and continue to offer a compelling user experience to its billions of users.

Facebook has also launched Reels, a feature that allows users to create and share short-form video content. This feature is similar to TikTok, which has seen massive success in recent years. By offering Reels, Facebook aims to provide a similar experience to TikTok users and keep them engaged on its platform.

What’s next for Facebook (Meta)?

Facebook is having a hard time compared to its position a couple of years ago. Ad growth is stalling, the Metaverse didn’t move far from being just a concept, and a hiring freeze has been extended. Well, considering the Facebook company size of 71,970 employees, the last point isn’t as bad. But the company still needs to initiate some changes to regain its footing.

Zuckerberg says, “We have this long-term roadmap to solve different challenges.” For one, there will be a smaller emphasis on the metaverse, augmented reality, artificial intelligence, and virtual reality than last year. Other plans aren’t disclosed yet.

Sources:

Facebook Investors, CNBC

List of mergers and acquisitions by Meta Platforms, Wikipedia

Meta settles Cambridge Analytica scandal case for $725m, BBC

FTC Imposes $5 Billion Penalty and Sweeping New Privacy Restrictions on Facebook, Federal Trade Commission