FOMO (fear of missing out) is a remarkably useful acronym, especially in the context of modern digital communication and trading. It succinctly captures the powerful psychological phenomenon that drives people to make impulsive decisions.

Fun fact: acronyms have been present in human communication for a very long time. Even in ancient Rome, the abbreviation SC for Senatus Consulto was used widely to inscribe essential information on their currency.

Let’s not fall into the trap of assuming that everyone automatically knows the meaning of a popular acronym like FOMO, especially when it comes to trading. In this guide, you’ll learn the depths of FOMO and explore its impact on trading activities. Moreover, you’ll get equipped with strategies to conquer it.

Signs and symptoms of FOMO in trading behavior

FOMO refers to the feeling of anxiety and unease that arises when individuals feel they are missing out on rewarding or enjoyable experiences, events, or opportunities. It’s a very common phenomenon in the digital age, fueled by the desire to stay connected and relevant.

If you’re unsure whether you’re experiencing FOMO, here are some telltale signs to watch out for when trading on Binomo:

- You find it challenging to say no to potential trades, even if the setups are not in line with their strategies.

- When you see others profiting from a particular market move, you feel frustrated and excluded from the gains.

- You’re in a constant state of dissatisfaction with your trading performance.

- You spend excessive time on social media platforms, constantly seeking trade ideas and market updates.

- You engage in rapid trading, always looking for action and excitement in the markets.

- There is a tendency to frequently switch strategies or jump between different assets, looking for the next “hot” opportunity.

- You’re overly influenced by the opinions and actions of others and seek validation and support from trading communities or forums.

When traders experience FOMO, they may even feel physically tired due to the constant state of alertness and restlessness. This state can distract you from focusing on your tasks or responsibilities, as well as trigger feelings of sadness, anxiety, or even depression. So, FOMO is not something you’ll want to cling to.

Where does FOMO come from?

FOMO goes back to people’s evolutionary history. In the early stages of human existence, survival depended on being aware of potential threats both to individual people and the larger group. In small tribes, being “in the know” about new food sources, dangers, or opportunities was critical for survival.

The amygdala, a part of the limbic system in the brain, plays a tremendous role in the experience of FOMO. Its primary function is to detect potential threats to our survival. Not having vital information or feeling excluded from the group triggers the amygdala to engage the “fight or flight” response.

In the modern world, though, FOMO mostly manifests in anxiety or stress. While the amygdala’s response was crucial in primitive conditions, it’s not as helpful in today’s complex and interconnected world.

A cautionary tale about FOMO

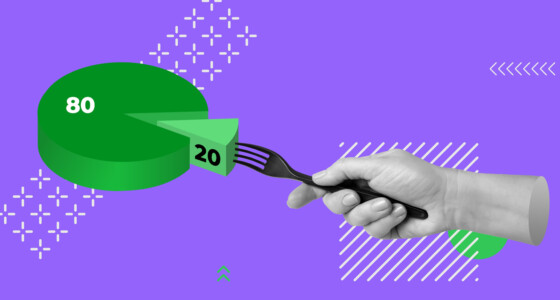

A recent study conducted by the CFA Institute highlighted that half of Gen Z investors admitted to making investment decisions driven by the fear of missing out.

The rise of social media has played a significant role in amplifying FOMO among younger investors. Platforms like YouTube, Instagram, and TikTok have become popular sources of information for these investors to “learn” about investing. While these platforms can be valuable for gaining knowledge, they also present potential dangers, especially when it comes to FOMO-driven decision-making.

As a result, young investors find themselves investing in assets they don’t comprehend, solely because they fear being left behind while others seemingly profit.

Strategies to overcome FOMO

Below are a few practices to help liberate you from the grip of trading FOMO:

Value your attention

Recognize that attention is a finite and precious resource. Every minute spent chasing the latest market trend or reacting to others’ actions is a minute taken away from critical analysis and disciplined trading.

Slow down

By slowing down in everyday activities, such as eating, driving, or engaging in conversations, you can cultivate mindfulness and awareness. This mindfulness extends to trading, where being present in the moment helps you make more well-informed decisions.

Focus on achieving your goals

FOMO often starts with a lack of clarity around your goals. But when you have a deep understanding of why you’re achieving your goals and the positive impact it will have on your life, you become less concerned about what others are doing in the markets.

Be willing to not have it all

It’s not necessary to participate in everything. And the acceptance of not having it all teaches you to cut off trades that don’t fit into your strategy, even if they seem appealing at the time.

Eliminate unhelpful things

Filter out unnecessary market noise and unreliable sources of information. Social media can especially be a breeding ground for FOMO-induced behavior, so reduce the time spent on trading-related social media platforms.

Relish feeling out of the loop

Sure, there are countless opportunities and exciting events happening around you, both in trading and in life. However, you can’t be everywhere or participate in everything, and that’s perfectly okay.

Conclusion

Fear of missing out is a powerful and paralyzing trap that can profoundly impact your life, especially in the fast-paced world of trading. However, the encouraging news is that FOMO isn’t a permanent state. By consciously choosing to be present and mindful (with strategies suggested in this article), you can break free from its grip and its negative effects. Don’t let these silly thoughts hinder your achievements on Binomo.

Sources:

All about FOMO: overcoming your fear of missing out, Psych Central

The bulls are back on Wall Street, but so is dangerous FOMO, The Sydney Morning Herald

10 ways to overcome fear of missing out, Psychology Today